FIRST BANCORP /PR/ (FBP)·Q4 2025 Earnings Summary

First BanCorp Posts Record Year as Net Interest Income Hits All-Time High

January 27, 2026 · by Fintool AI Agent

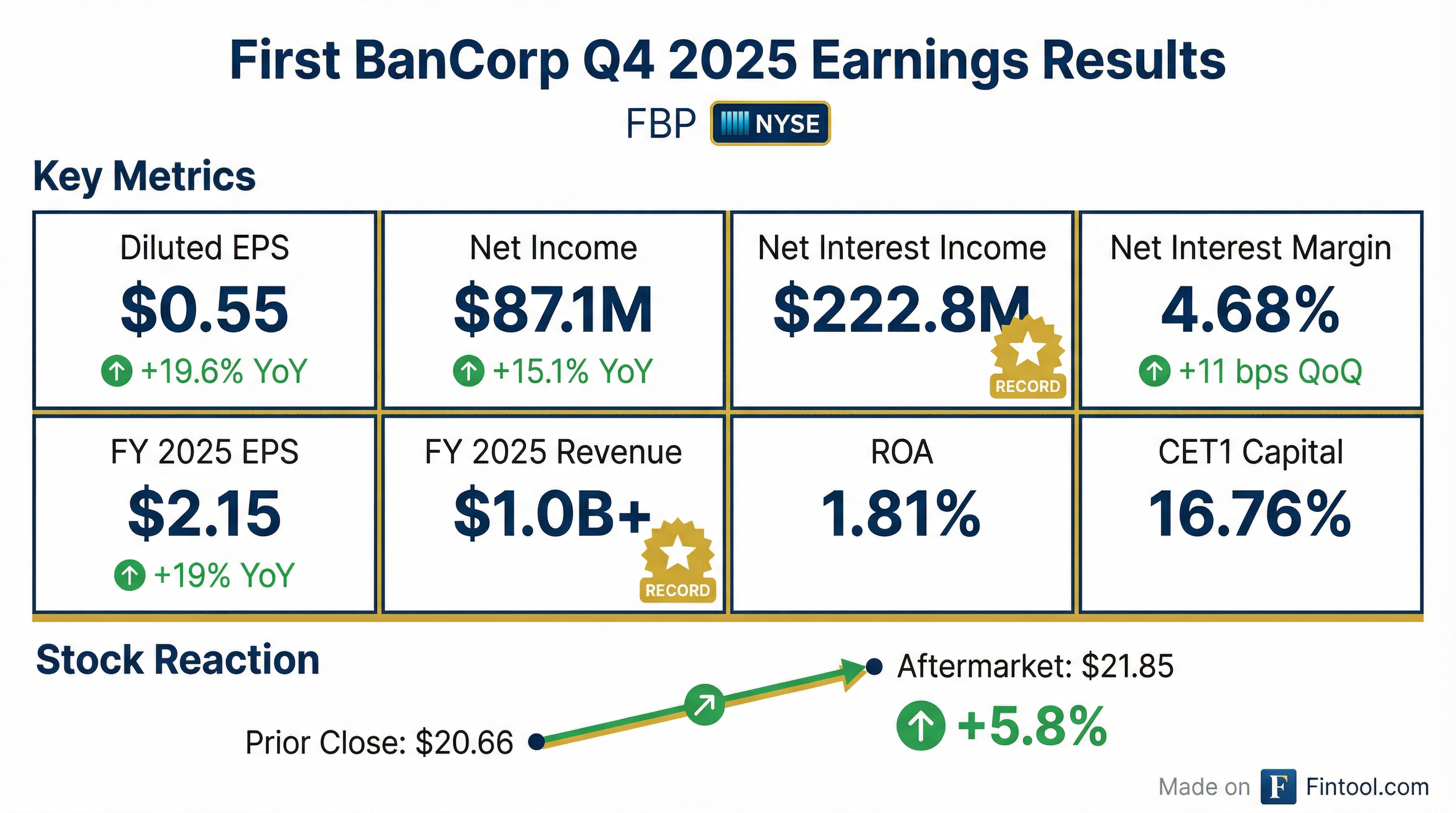

First BanCorp (NYSE: FBP) delivered a strong finish to a record-breaking year, reporting Q4 2025 diluted EPS of $0.55 and full-year EPS of $2.15—a 19% increase from 2024. The Puerto Rico-based bank holding company crossed the $1 billion revenue threshold for the first time and achieved an all-time low in non-performing assets. Shares rose 5.8% in after-hours trading following the release.

Did First BanCorp Beat Earnings?

Yes—FBP beat on both EPS and revenue. Q4 2025 diluted EPS of $0.55 exceeded the Street's expectation of ~$0.49, representing a beat of approximately 12%.* Net income of $87.1 million came in 15% above Q4 2024's $75.7 million.

For the full year, First BanCorp generated record net income of $344.9 million, EPS of $2.15 (+19% YoY), and a return on average assets of 1.81%.

What Drove the Record Results?

Net interest margin expansion was the star of the quarter. NIM increased 11 basis points sequentially to 4.68%, driven by:

- Asset mix shift: Redeployment of cash flows from lower-yielding securities into higher-yielding loans and investments

- Deposit cost management: Average cost of interest-bearing deposits declined, particularly government deposits (down 31 bps)

- Loan repricing benefits: Higher-yielding commercial and construction loans offset downward repricing on variable-rate loans

CEO Aurelio Alemán emphasized the franchise's diversification: "Our results continue to demonstrate the resiliency of our well-diversified business model and our ability to deliver consistent service to our clients and strong financial performance for our shareholders."

How Did the Balance Sheet Perform?

Loans grew while deposits remained stable. Total loans increased $80.8 million (+0.6% QoQ) to $13.1 billion, driven primarily by commercial and industrial growth in Puerto Rico.

Core deposits (excluding brokered and government deposits) increased $266.5 million, with non-interest-bearing deposits rising $210.3 million in the Puerto Rico region. Government deposits declined $422.6 million, a strategic move to reduce funding costs.

What's the Asset Quality Picture?

Credit remains exceptionally clean. Non-performing assets fell to $114.1 million (0.60% of assets), down from $119.4 million in Q3 2025 and reaching an all-time low level.

Net charge-offs remained stable at 0.63% annualized, primarily driven by consumer loans. The provision for credit losses increased to $23.0 million from $17.6 million, mainly reflecting loan growth in commercial portfolios.

How Did the Stock React?

FBP shares jumped in after-hours trading. The stock closed at $20.89 on January 27, up 1.1% during regular hours, then surged to $21.85 in after-market trading—a 5.8% gain from the prior day's close of $20.66.

The positive reaction reflects:

- Record annual results exceeding expectations

- Continued NIM expansion despite rate cuts

- Strong capital return ($78M in Q4 alone)

- Clean credit quality at cycle lows

Year-to-date, FBP shares have traded between $16.40 and $22.61, with the stock now approaching the upper end of that range.

What Did Management Guide for 2026?

Management reiterated its 2026 priorities with a constructive outlook on the Puerto Rico economy:

CEO Alemán highlighted several positive economic drivers for Puerto Rico:

- Record tourism: Airport passenger traffic up 8% to 13.6 million passengers

- Manufacturing investment: Over $2.2 billion in announced capacity expansion driven by onshoring efforts

- Federal funds: $40 billion in disaster relief funds still to be deployed for infrastructure development

- Labor market: Unemployment rate hovering around 5.7%

However, management cautioned that "consumer confidence may moderate somewhat... impact of tariff-related pricing, inflationary pressures and geopolitical tensions will continue to develop through the year."

Capital Return: What Did Shareholders Receive?

First BanCorp returned $78.3 million to shareholders in Q4 2025:

- Stock repurchases: $50.0 million (2.5 million shares at avg. $19.88)

- Dividends: $28.3 million ($0.18 per share)

Dividend Increase Announced: The board approved an 11% increase to $0.20 per share quarterly starting Q1 2026. Management also indicated plans to continue repurchasing approximately $50 million in shares per quarter through the end of 2026.

For the full year, the net payout ratio reached approximately 95% of adjusted earnings. Since the buyback program began in 2021, FBP has repurchased over 28% of shares outstanding. Capital ratios remain well above regulatory minimums:

Tangible book value per share reached $12.29, up 24% year-over-year.

What Changed From Last Quarter?

Q4 vs Q3 2025 highlights:

Q3 2025 included a one-time $16.6 million tax benefit from the reversal of valuation allowance following Puerto Rico's Act 65-2025. Excluding special items, adjusted net income increased 5.9% sequentially.

The efficiency ratio improved to 49.3%, well below the 52% operating target, reflecting disciplined expense management alongside record revenues.

Forward Estimates: What Does the Street Expect?

Analyst consensus for FBP heading into 2026 (based on 6 analysts):*

Full year 2026 implied EPS of ~$2.11 suggests slight normalization from FY 2025's $2.15, which included the elevated Q3 2025 quarter with special items.

What Did Analysts Ask About?

Key themes from the Q&A session:

NIM Outlook: CFO Orlando Berges provided detailed guidance: "Based on current expectations that we have for interest rate changes in the year, in 2026, and our projected loan and deposit movements, we expect that margin will grow 2-3 basis points per quarter during 2026." The bank has $848 million in securities maturing during 2026 with an average yield of 1.65%, which will be reinvested at higher rates.

Tariff Impact on Auto Lending: CEO Alemán addressed the auto market headwinds: "When we look at what happened last year, the overall market retail, on the retail side was down 10%, and most of that contraction happened after the tariff were implemented... we believe we have seen months of stabilization." Management expects an additional 5% contraction this year but no growth in the auto/consumer segment.

Deposit Competition: When asked about funding cost trends, management noted brokered CDs are repricing lower as they mature (originally issued at 9-18 month terms), and government deposits tied to market indexes will continue to reprice. Transaction accounts showed only a 14% beta during the rising rate cycle, so similar stability is expected on the way down.

Florida Expansion: The bank opened a new branch in Boca Raton during Q4 and continues to look for both organic and inorganic growth opportunities. CEO Alemán noted: "Organic growth is the most efficient in terms of returns. The others, you know, we continue to play them both as markets show opportunities."

Non-Interest Bearing Deposits: Management emphasized growing core relationships as a key priority. Digital initiatives showed strong results with 95% of deposit transactions captured through self-service channels and active retail digital users up 5% YoY. A new branch is planned for the West Coast of Puerto Rico in a town with only one competing bank.

Key Risks and Considerations

Management highlighted several factors to monitor:

- Interest rate sensitivity: ~50% of commercial loans are variable rate, creating repricing pressure if Fed cuts continue

- Puerto Rico economic exposure: Bank remains tied to local economic conditions and reconstruction funding flows

- Government deposit volatility: Public sector deposits can fluctuate significantly ($422.6M decline in Q4)

- Consumer credit normalization: Net charge-offs in consumer loans running at 2.20% annualized

The Bottom Line

First BanCorp delivered a strong close to a record year, demonstrating the resiliency of its Puerto Rico-focused franchise. With NIM still expanding, asset quality at historic lows, and capital returns approaching 100% of earnings, the bank enters 2026 well-positioned. The stock's 5.8% after-hours pop suggests investors are rewarding management's execution and constructive outlook.

Values retrieved from S&P Global.

Related Links: